- Stocks in Play

- Posts

- Stocks in Play - November 13th 2024

Stocks in Play - November 13th 2024

TLDR Stocks in Play: RKLB, HNST, CYBR, CAVA

Stocks in Play - November 13th 2024

TLDR Stocks in Play: RKLB, HNST, CYBR, CAVA

Welcome to today's Stocks in Play report. Below are the key stocks to watch, along with brief Xray and Analysis. My main source of news is BenzingaPro. Check out their 2 Week Free Trial. The other tools I use daily are listed at the bottom of the email.

1) Rocket Lab USA Inc (RKLB)

Industry Group: Aerospace & Defence, Market Cap: $7.35b, Float: 309m, Short Interest: 19.8%, Days to Cover: 3.8, Exchange: NASDAQ

Catalyst: This is the first report this week from the ‘‘Space Stocks’’. This has been a great story theme the past few months. Slight Revs Beat. +55% YOY. EPS Beat (though negative). New Annual Launch Record. Completed production in time and on Budget for NASA Mission. $1b Backlog. Multi Launch Contract All time highs are above $21.30. Currently sitting at $19 Pre Market (+30%). Others reporting this week are LUNR (Thursday BMO), ASTS (Thursday AMC). This theme was one of my focuses for this weeks earnings. It is a story stock though so I certainly wouldn’t be falling in love with it.

2) Honest Company Inc (HNST)

Industry Group: Specialty Stores Market Cap: $480m, Float: 65m, Short Interest: 3%, Days to Cover: 1.1, Exchange: NASDAQ

Catalyst: Provider of makeup, wellness, skin care products. Nice Revs Beat. EBITDA Beat, Expanding Gross Margins. 2021 IPO well below original listing Price ($23). Coming out of a long base. Investors and Traders may be looking for ELF type move here however the growth numbers don’t match. Still a good SIP idea for today and possible sustained move upward.

3) CyberArk Software (CYBR)

Industry Group: Packaged Software, Market Cap: $13b, Float: 41m, Short Interest: 3.3%, Days to Cover: 3.2, Exchange: NASDAQ

Catalyst: Big EPS Beat, Reasonable Beat on REVS. Growing Sales 25% YOY, ARR Growing 31%. Raised EPS & Sales Guides. CFO Stepping Down replaced by Deputy. Transitioning to Advisory Role. This is a planned succession. Nice rising Base on the chart for most of 2024.

4) CAVA Group Inc (CAVA)

Industry Group: Restaurants, Market Cap: $16.5b, Float: 96m, Short Interest: 11.7%, Days to Cover: 3.6, Exchange: NYSE

Catalyst: Beat Sales & EPS. Growing Revs 39% YOY. Raised Net Restaurant Openings. Also Raised Sales Growth Outlook from existing restaurants 9% to 12.5% midpoints. Stock has been on a huge tear and has investors tearing their hair out on it’s mind numbing valuation. My guess is it pulls back soon but I wouldn’t be surprised for it to burn those trying to short it today before that occurs. 5 Analyst Upgrades this morning.

Honorable Mentions to: RIVN - Volkswagen upping their investment to $5.8b. However $5b of this was already announced. To me this is a fade however it’s worth monitoring. SPOT - Missed on Revs & EPS however Gross/Operating Margins are one of the most important KPIs for Spotify and these improved. Which may be enough to make this work today. FLUT - Beat on Revs, EPS, Modest Guide Raise, Warned against sports betting in current Q. Launched Buyback program.

Market Awareness

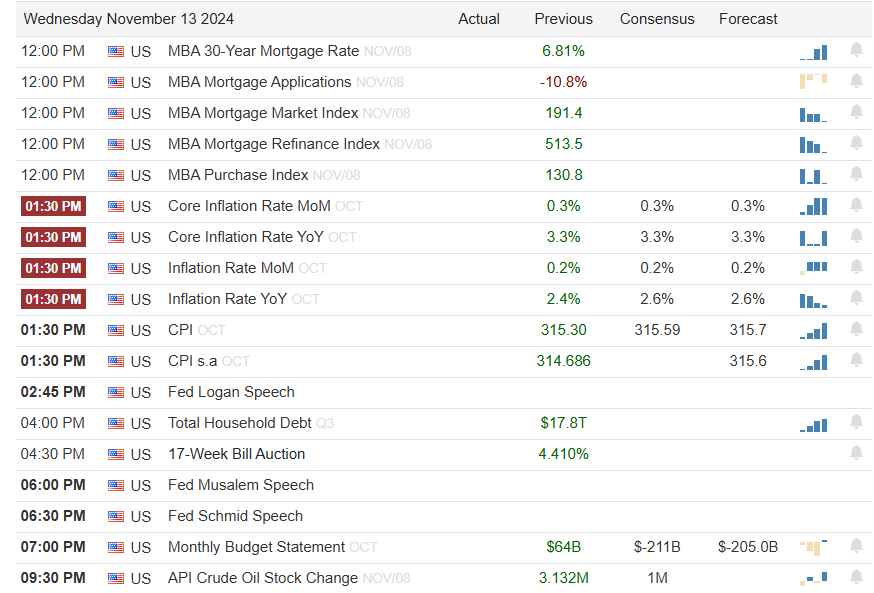

Expecting volatility today with CPI data and FED Speakers. Stocks in Play work regardless but will still be in hit and run mode in this run away Bull Market until we get a sustained pullback that will set stocks up better for swings. In my opinion one should keep trading here and leave their brain at the door. In the past I’d be so skeptical around now that I’d be trying to short. Now I just dance until the music stops while all the time protecting wins and managing risk tightly and on a very short time frame.

After Hours I’m watching: NU, CSCO,

Tomorrow Morning I’m watching: JD, LUNR, DIS

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free/Paid)

Benzinga Pro - News Source + News Squawk + Earnings Data (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

Notion - Research, Note Taking, Database Creation (Free)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply