- Stocks in Play

- Posts

- Stocks in Play - November 12th 2024

Stocks in Play - November 12th 2024

TLDR Stocks in Play: SE, CAMT, TGI, SHOP

Stocks in Play - November 12th 2024

TLDR Stocks in Play: SE, CAMT, TGI, SHOP

Welcome to today's Stocks in Play report. Below are the key stocks to watch, along with brief Xray and Analysis. My main source of news is BenzingaPro. Check out their 2 Week Free Trial. The other tools I use daily are listed at the bottom of the email.

1) SE Limited (SE)

Industry Group: Internet Retail, Market Cap: $53.75b, Float: 521m, Short Interest: 2.8%, Days to Cover: 3.5, Exchange: NYSE (ADR)

Catalyst: Strong Revenue Beat 31% vs 23% est., Very slight miss on EPS but likely to be ignored because of the Rev Beat. All aspects of Biz growing. Stock at $100 Psych level with a lot of Hedge Funds bullish on it. Full year guide of ‘‘mid 20s’’. This report is not likely to have changed their mind. If interested in fundamental aspects of this co. my fellow countryman Wolf of Harcourt will likely have a write up on earnings on his website in coming days. Plenty of room to run on this in nice uptrend.

2) Camtek Ltd (CAMT)

Industry Group: Electronic Components Market Cap: $3.5b, Float: 27m, Short Interest: 11%, Days to Cover: 5.6, Exchange: NASDAQ

Catalyst: Nice Beat Revs, Reasonable Beat EPS, Beat Q4 Guide & Beat FY24 Guide, They make components for Semiconductor Industry, Revs up 40% YOY, Good Short Interest, Low Float. Stock is essentially flat for 2024, peaked in a similar way to SMCI minus the fraud! Low Volume Premarket.

3) Triumph Group (TGI)

Industry Group: Aerospace & Defence, Market Cap: $1.3b, Float: 75m, Short Interest: 11.5%, Days to Cover: 9, Exchange: NYSE

Catalyst: Big EPS Beat, Slight Sales Beat, Inline Revs Guide, Raised EPS Guide to $0.70 (est. $0.41), Revs only Growing 1%, Short Interest relatively high with a reasonable float.

4) Shopify Inc (SHOP)

Industry Group: Information Technology Services, Market Cap: $116b, Float: 1.21b, Short Interest: 1.7%, Days to Cover: 3.6, Exchange: NYSE

Catalyst: Small Revs Beat, Rev Growth Accelerating, FCF Margin Expansion, GMV Beat, Guide Revs Beat, Inline Gross Profit. Nothing mind blowing here but positive none the less and well known growth stock. Making it’s inclusion today worthwhile. However stock has ran up a lot. Sitting just above $100 Pre Market, might be a stretch.

Honorable Mention to: EVGO - Huge Short Interest (30%+), Reported reasonable numbers., TSN Solid Beat, HD Solid Earnings though stock at ATH. GRAB solid upside report. These are worth knowing about if Relative Volume happens to come in at the open.

Market Awareness

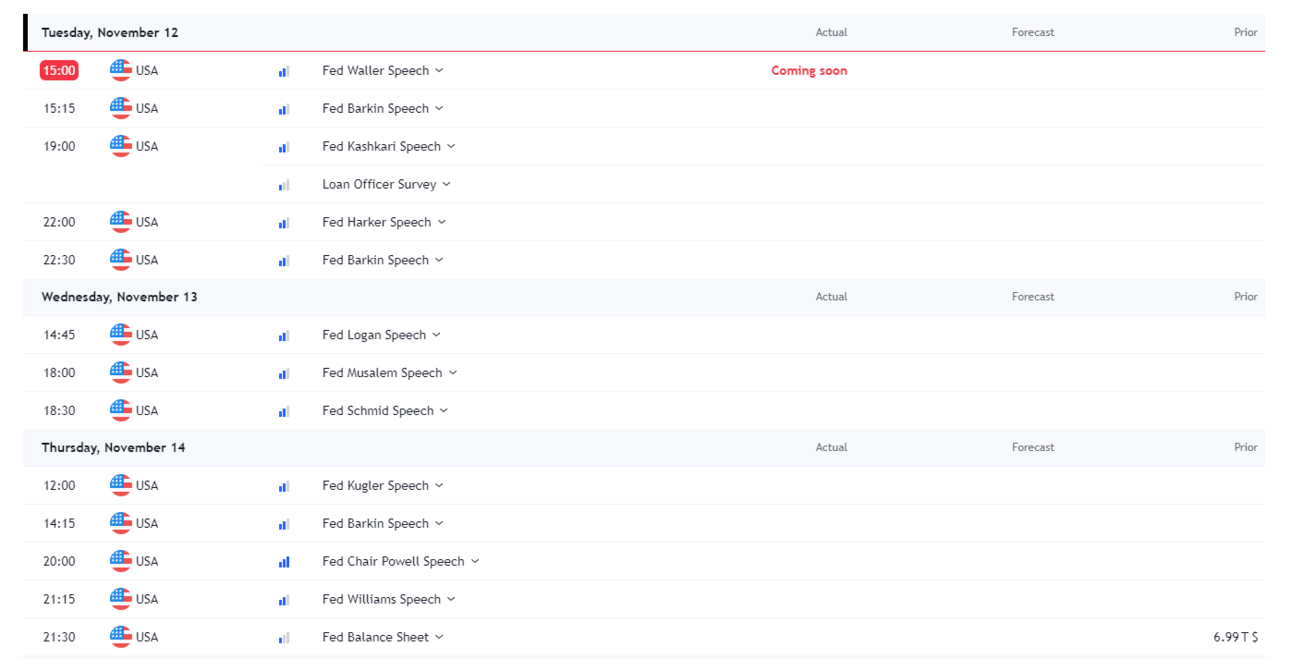

Still on the Trump euphoria train, crypto all time highs again over night. Some strange moves overnight with many stocks running only to open the pre market deep red and recover throughout the day. Nothing has changed for me from yesterday Day Trade environment and the longer this goes on the more hit and run I will be before some sort of inevitable short term rug pull. FED speeches all week are worth noting. Posted below (GMT Time)

After Hours I’m watching: RKLB, CART, CAVA, SPOT

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free/Paid)

Benzinga Pro - News Source + News Squawk + Earnings Data (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

Notion - Research, Note Taking, Database Creation (Free)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply