- Stocks in Play

- Posts

- Stocks in Play - April 21st 2025

Stocks in Play - April 21st 2025

TLDR Stocks in Play: NFLX, TQQQ, MARA, Patience....

Stocks in Play - April 21st 2025

TLDR Stocks in Play: NFLX, TQQQ, MARA, Patience….

Welcome to today's Stocks in Play report. Below are the key stocks to watch, along with brief x-ray and analysis.

If you find this Newsletter helpful and ever want to say thank you then feel free to Buy Me a Coffee. It’ll inspire me to work faster….

1) Netflix (NFLX) (Rating: B-, Single-Day)

Industry Group: Technology Services, Market Cap: $421bb, Float: 425m, Short Interest: 1.9%, Days to Cover: 1.59, Exchange: NASDAQ

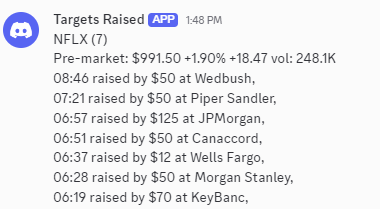

Catalyst: Strong beat on EPS ($6.61 vs est. $5.68), Slight beat on Revs, Strong Operating Margins & FCF. Solid Beat on Guide for EPS, Revs and Op Margins for next Q. No change for full year guidance. NFLX is unaffected by all the Tariff and Macro drama. Will require the market to bounce but this is the only obvious individual stock play I see today. Significant number of Upgrades to the stock also from Analysts.

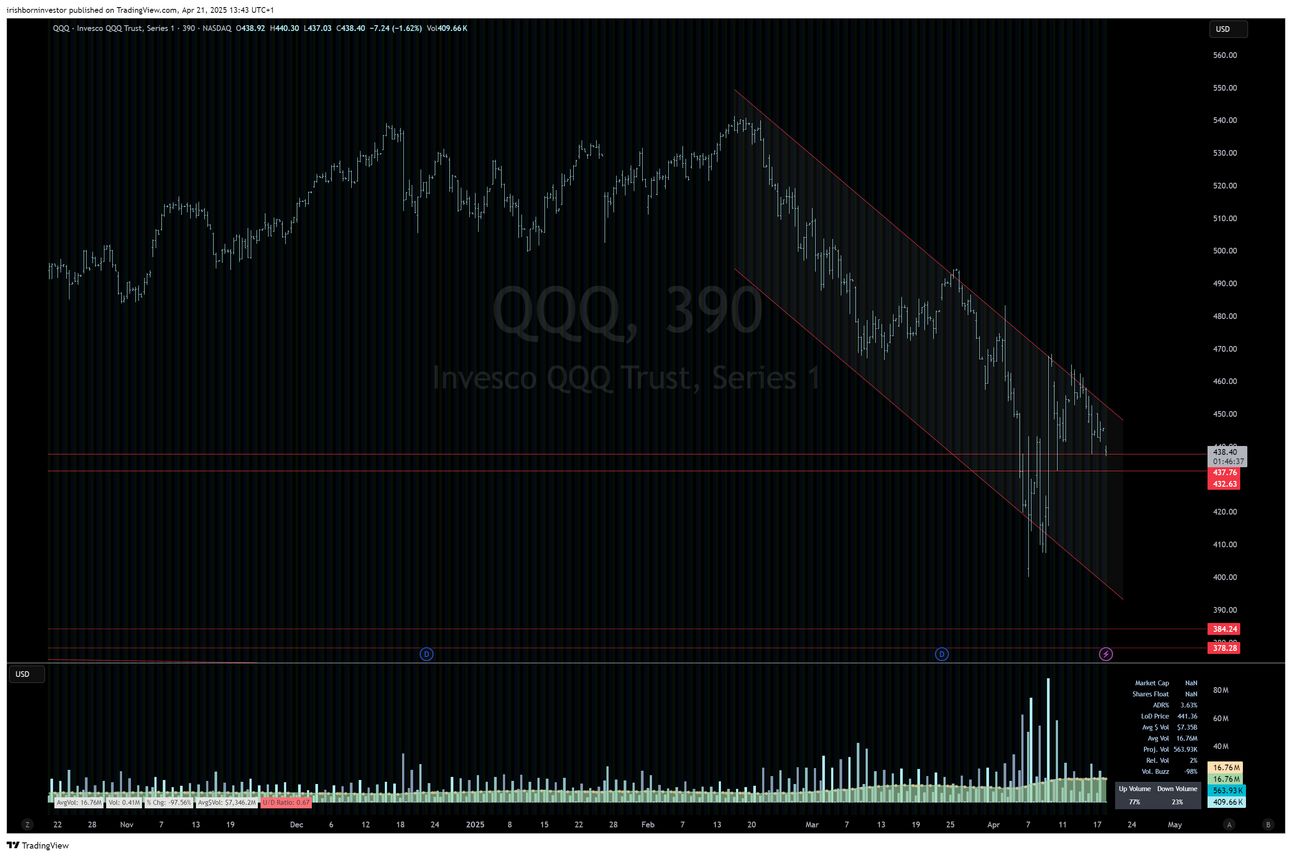

Honorable Mention to: TQQQ - I would be quite wary of being short today. We are just one headline away at all times from a face splitting pop. QQQ at an interesting spot this morning undercutting last weeks low. Needs to hold and bounce here. The selling may accelerate here and we break down but for me the RR on shorting isn’t there on this Monday gap down. I am looking at long TQQQ today with the idea that the market is the main stock in play. GOLD & BITCOIN stocks are also strong. MARA is my preferred BTC stock today.

Market Awareness

Slow start to the week news wise. That being said the market has had a steady bleed overnight right into last weeks lows. I’d take this gap down to work against any day vs a gap up on a Monday morning. Lets see if buyers step in. I note the VIX is perky this morning I will be keeping a close eye on that today.

Patience this morning no need to rush into anything. Monday mornings particularly after a long weekend are always my most relaxed starts.

After Hours I’m Watching: AGNC, CALX, MEDP (Earnings)

Tomorrow Morning I’m Watching: GE, MMM, RTX, DHR, LMT, ELV (Earnings)

Top Pick Watchlists:

LONG: ALAB, HNST, SNOW, ESTC, RKLB, SMTC, URBN, PLTR, GAP, TSLA, SE, RDDT

LONG: CRDO, MRVL, OKTA, FIVE, RBRK, AVGO

LONG: CEG, FUBO, BLK, GE

LONG: MAT, PINS, AXON

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk + Earnings Data (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply